Mark and Marcella have been working together in Legacy Builder Group since 2008. They are children of immigrant parents from Trinidad and Tobago who came to America and worked hard to build their American Dream for their family.

From the time they were old enough, Mark and Marcella worked side by side in their parent's graphic design and sign company, learning the details of entrepreneurship, leadership and running a family business. With the lessons learned from their upbringing, both Mark and Marcella pursued their desire to increase their financial knowledge and are educated in the areas of retirement planning ,asset protection, legacy planning and behavioral economics. They believe in remaining "forever students".

Today, Legacy Builder Group is proud to be the home to a team of exceptional financial professionals that understand the importance of education, integrity and serving every client and their families, like family.

Your Legacy, Our Purpose

A legacy is something passed down or received from an ancestor or predecessor. It is about more than money; it is about creating your American Dream. Creating a family legacy to pass down to the next generation is a responsibility that we all bare.

In fact, accepting responsibility for self, family and community is at the heart of sustained financial health. At the very core of what we do is our commitment to protecting your legacy. You work hard to build a future for yourself and your family.

You deserve a team that takes the time to understand your goals and has the knowledge to help you achieve them.

Mark and Marcella have made it their mission to honor their family legacy and have equipped families with the knowledge and strategies to do the same.

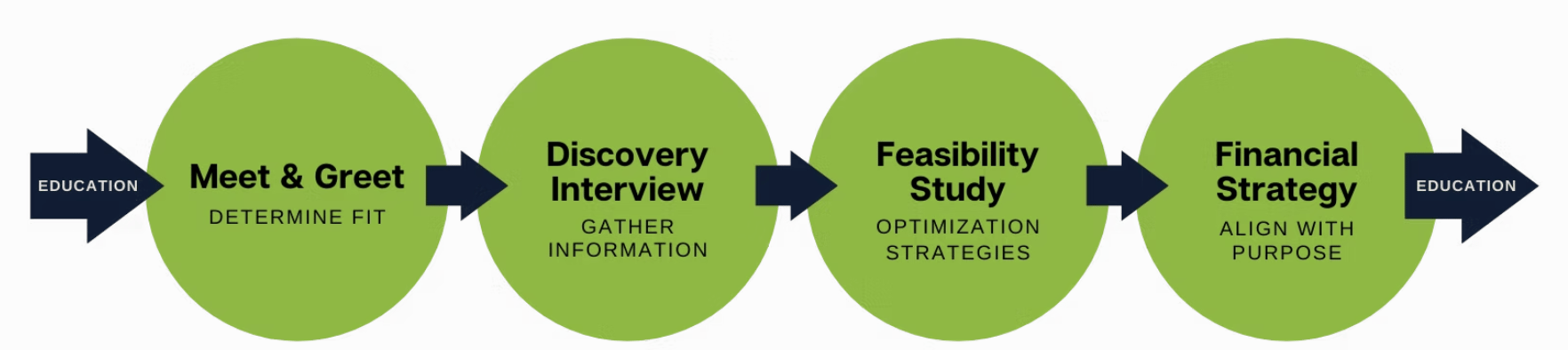

Meet and Greet

This is the time you meet with one of our coaches and mutually gauge whether the client and coach can work together. If it feels like a good fit, we will partner together to reach your financial goals.

Building your financial foundation is the beginning of creating your Purpose Plan. We implement a comprehensive, process - driven approach to retirement planning. We guide our clients down the path to a better financial strategy with an analysis of goals and needs.

Our process is thorough, yet simple:

Assess the readiness of our clients to retire in the future given their current lifestyle and assets.

Develop strategies to get our clients closer to their goals. This process is on-going and continues throughout the lifetime of the plan.

Through asset optimization we can create a financial strategy that lasts as long as you do.

Discovery Interview

We will provide you with coaching pertaining to your situation. In our Discovery Interview, we will gather data and identify your current financial situation and examine your philosophy, attitude and behavior in handling your money.

We will help you prioritize where your money should be going.

Feasibility Study

In our Feasibility Study we will see which recommendations make sense and implement our agreed upon strategies.

You will be receiving the following reports:

Social Security Timing Report

Tax Clarity Report

Portfolio Diagnostic Report

Portfolio Cost Analysis Report

Lifetime Analyzer

Once we input your data into the Lifetime Analyzer software, we get a 360° view of your current situation. It helps layout where you are today and what your future may look like. We can then make adjustments to lead you toward your financial goals. In the asset optimizer phase, we bring all your non-qualified assets together to create a tax efficient plan for your future.

Portfolio Diagnostic Report

The Portfolio Diagnostic measures your current investment information. The purpose of this personalized Portfolio Diagnostic is to help you understand how various mixes or styles of investment portfolios may have performed in the past.

Personalized Financial Strategy

We then complete a written plan of action and create your own personalized financial strategy. Every year, we will notify you that your annual review is approaching. It is important to meet and make adjustments as needed. The objective is to keep your plan on-track and in alignment with your goals.

Remember, your financial strategy is a movie and not a snapshot. It is always changing. Therefore, we are committed to your long-term success and want you to create a life that you love.

Contact us for more information about our firm and the services we offer.

We welcome the opportunity to speak with you.

[email protected] (866) 664-6711

Download Your FREE Resource

4 Conversation Every Family Should Have To Achieve Multi-Generational Wealth

Trusted by millions. Actually enjoyed by them too.

Most business news feels like homework. Morning Brew feels like a cheat sheet. Quick hits on business, tech, and finance—sharp enough to make sense, snappy enough to make you smile.

Try the newsletter for free and see why it’s the go-to for over 4 million professionals every morning.